Crypto Guide: Cryptocurrency Exchange

Last Update: October 18th, 2024

A cryptocurrency exchange is a digital platform that allows users to trade between cryptocurrencies and traditional fiat currencies like the U.S. dollar, euro, or yen.

Whether you’re buying Bitcoin (BTC), Ethereum (ETH), or any other digital assets, cryptocurrency exchanges act as the gateway into the world of crypto, facilitating trades, deposits, and withdrawals.

Choosing the right crypto exchange is a critical step for anyone looking to enter the crypto market. Each platform offers different features, ranging from crypto trading tools and security measures to fee structures and a variety of supported digital assets. The best exchange for you depends on your trading needs—whether you prioritize low fees, robust security, or a wide range of available cryptocurrencies.

In this guide, we’ll explore the different types of exchanges, their features, and how to choose the right one for your crypto journey.

*Don’t know what a cryptocurrency is? Check out ‘’.

Understanding Cryptocurrency Exchanges

Cryptocurrency exchanges play a vital role in the crypto market, acting as a bridge between fiat currencies like USD, EUR, and JPY, and digital assets such as Bitcoin, Ethereum, and other altcoins. These exchanges facilitate the buying and selling of crypto, allowing users to convert their traditional currency into cryptocurrency, or vice versa. Without crypto exchanges, it would be difficult for most people to access or trade digital assets.

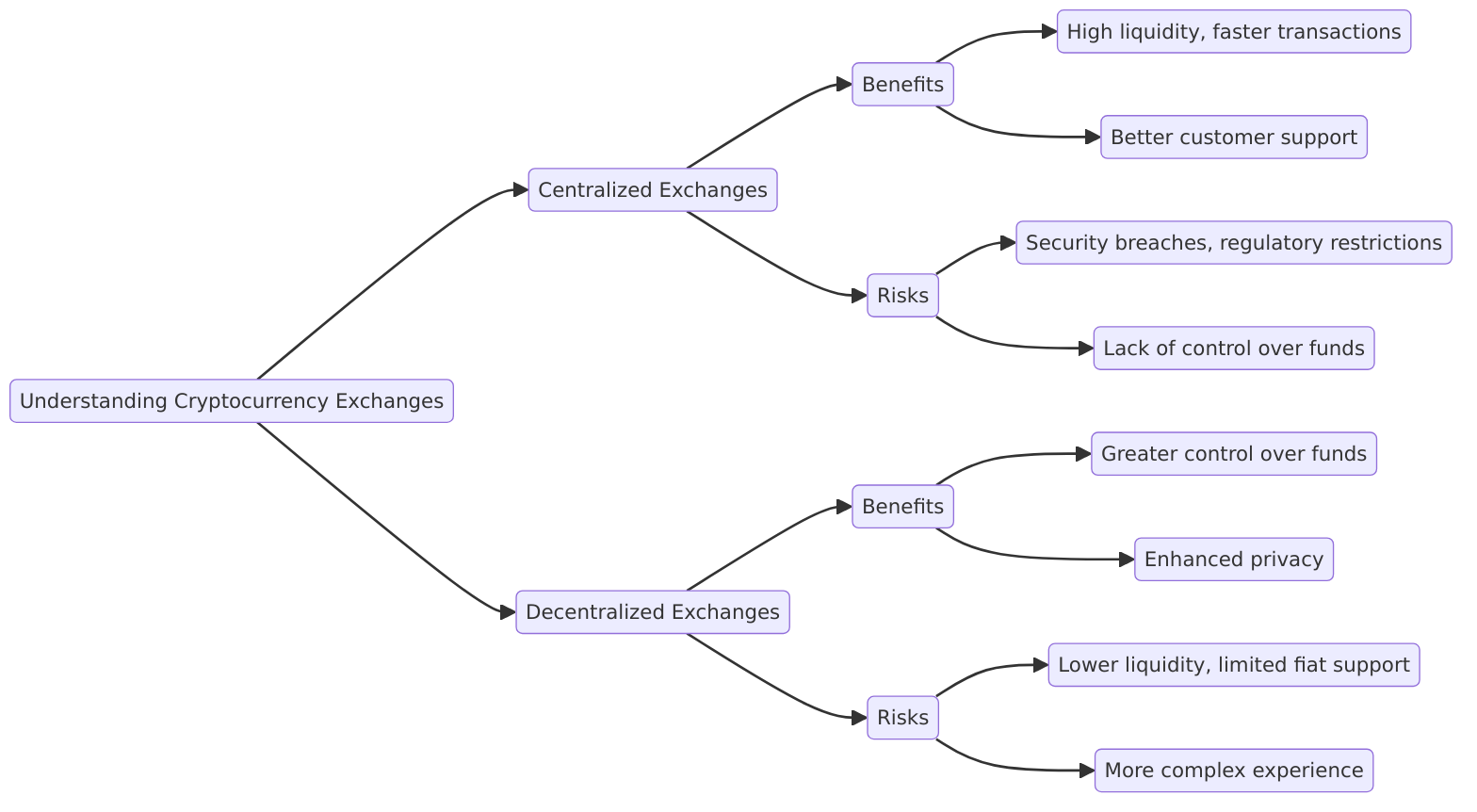

There are two main types of cryptocurrency exchanges: centralized exchanges (CEX) and decentralized exchanges (DEX). Each has its own benefits and risks.

Centralized Exchanges (CEX)

These platforms are managed by a central authority or company, which acts as an intermediary for trades. Examples include Binance, Coinbase, and Kraken. Centralized exchanges often provide more user-friendly interfaces, customer support, and higher liquidity. However, since they hold user funds, they can be vulnerable to hacks and are often subject to regulatory oversight.

- Benefits: High liquidity, faster transactions, better customer support, easier fiat onramps.

- Risks: Vulnerability to security breaches, potential regulatory restrictions, lack of full control over your funds.

Decentralized Exchanges (DEX)

Unlike centralized exchanges, DEXs operate without a central authority. They allow peer-to-peer transactions directly between users through smart contracts. Examples include Uniswap and SushiSwap. DEXs provide more privacy and control over your funds, as you trade directly from your wallet. However, they can have lower liquidity and may not support fiat currency transactions.

- Benefits: Greater control over funds, enhanced privacy, no need for intermediaries.

- Risks: Lower liquidity, limited fiat currency support, potentially more complicated user experience.

Choosing between a centralized and decentralized exchange depends on your priorities, whether you value security, ease of use, or control over your assets.

Key Features of Leading Crypto Exchanges

When selecting the best cryptocurrency exchange, it’s important to evaluate a few key features that can significantly impact your trading experience. Whether you’re a beginner or an experienced trader, these essential factors will guide you in choosing the right platform.

Security

Security is a top priority when it comes to crypto trading. Leading crypto exchanges offer robust security measures to protect your assets. Look for features such as:

- Two-factor authentication (2FA) for an extra layer of login security.

- Cold storage to keep the majority of user funds offline, safe from hacking attempts.

- Insurance policies that cover losses due to security breaches, ensuring peace of mind.

Platforms like Coinbase and Gemini are often considered among the best cryptocurrency exchanges because of their high security standards and regulatory compliance.

User-Friendliness

For newcomers, ease of use is crucial. Exchanges like Coinbase and Kraken are known for their intuitive interfaces, making it easy to navigate, buy, and sell crypto. Simple account setup, clear dashboards, and straightforward processes for deposits and withdrawals can make all the difference for crypto traders.

Low Fees

Crypto exchange fees can vary widely, and understanding the fee structure is important. These fees include:

- Trading fees: Typically charged as a percentage of the trade.

- Deposit and withdrawal fees: May apply when moving funds in or out of the exchange.

Platforms like Binance are known for their low trading fees, especially if you use their native token (Binance Coin, BNB) to pay transaction fees. Make sure you compare fees to avoid unnecessary costs, especially if you plan to trade frequently.

Wide Range of Supported Crypto Assets

The best exchanges support a large selection of crypto assets, allowing users to diversify their portfolio. Top exchanges like KuCoin and Crypto.com offer hundreds of coins, from popular cryptocurrencies like Bitcoin and Ethereum to smaller altcoins. This diversity is beneficial for those looking to explore new projects or invest in niche markets.

Trading Pairs and Liquidity

Having access to a variety of trading pairs is essential for traders who want to move easily between different cryptocurrencies. For example, pairs like BTC/ETH or ETH/USDT allow for smooth transitions between popular coins. Higher liquidity is equally important, as it ensures that trades are executed quickly without significant price slippage.

Exchanges like Binance and Kraken offer some of the highest liquidity in the market, making them a great choice for active traders.

When choosing the best crypto exchange, make sure it meets your needs in terms of fees, security, and trading options.

Best Cryptocurrency Exchanges

FXLeaders is proud to present an unbiased review of different cryptocurrency exchanges based on several factors, including the safety of clients’ funds, various services and instruments offered, and customer service.

Some questions frequently asked by prospective cryptocurrency users and traders include the following:

- What is the best cryptocurrency exchange I can use?

- What is the best digital currency exchange?

- What is the best cryptocurrency exchange platform available?

- Which Bitcoin exchange should I use?

- Where can I find an excellent Ethereum exchange?

- What is the best Bitcoin exchange platform available at the moment?

If you have ever wondered about some of these points, check out the following table, which contains much of the information you need to choose the best cryptocurrency exchange:

- Easy to use and intuitive layout

- Fantastic educational material

- One of the biggest and most well-known exchanges

- Great security features

- Best for beginners

- Debit and credit card

- Paypal

- Wire/bank transfer

- Cryptocurrency

- The biggest exchange in terms of volume by far

- Exceptional liquidity

- Low fees

- $1 billion

- Debit and credit card

- Wire/bank transfer

- Cryptocurrency

- Large number of crypto coins

- Offline cold storage for all crypto

- Top exchange for cybersecurity

- Offers Visa card to spend crypto

- Well-established exchange, with world famous sponsorships

- Debit and credit card

- Wire/bank transfer

- Cryptocurrency

- Insures all funds held in hot wallets

- Verified security by third-party auditors

- Professional-grade trading platform

- Very liquid

- Vast array of features

- Debit and credit card

- Wire/bank transfer

- Cryptocurrency

- One of the oldest crypto exchanges, launched in 2013

- Sophisticated features

- Suitable for beginners all the way to institutional investors

- Wide range of crypto educational material

- Competitive fees

- Debit and credit card

- Wire/bank transfer

- Cryptocurrency

- Large selection of coins

- Accepts customers from all over the world

- Competitive trading fees, with volume discounts

- One-stop shop for everything crypto

- Find new coins with KuCoin Spotlight

- Debit and credit card

- Paypal

- Wire/bank transfer

- Cryptocurrency

Coinbase – Ideal for Beginners

Coinbase is widely recognized as one of the best crypto exchanges for beginners, offering a user-friendly interface that makes trading easy. For anyone new to crypto, Coinbase simplifies the process of buying, selling, and managing crypto wallets with an intuitive platform and step-by-step tutorials. Additionally, the exchange provides educational content and even allows users to earn small amounts of cryptocurrency through its learning program, making it a great option for crypto enthusiasts looking to expand their knowledge.

Security is one of Coinbase’s key strengths, featuring industry-leading protections:

- Two-factor authentication (2FA) for added account security.

- Cold storage for 98% of funds, safeguarding user assets from online attacks.

- Insurance coverage of up to $250,000 per user in the event of a breach.

However, these features come at a cost. Coinbase is known for having higher fees compared to other exchanges, which can be a drawback for active traders or those making frequent transactions. Let’s break down the pros and cons.

Pros:

- Access to over 240 cryptocurrencies, one of the largest selections available in the U.S.

- Low minimums to fund your account and start trading.

- Quick and easy cryptocurrency withdrawals.

Cons:

- Higher fees than many other cryptocurrency exchanges.

- Fees aren’t always transparent, which can make it difficult to estimate the cost of trades.

Coinbase Advanced Trade Pricing

For users seeking lower fees and more advanced trading features, Coinbase Advanced Trade offers a more transparent pricing model. The fee structure is based on monthly trading volume and the liquidity of the asset being traded. Here’s a breakdown of the maker and taker fees for Coinbase’s advanced trading tiers:

| Level | Pricing Tier | Maker Fee | Taker Fee |

|---|---|---|---|

| Advanced 1 | Up to $1K | 0.60% | 1.2% |

| Advanced 2 | $1K to $500K | 0.35% | 0.75% |

| Advanced 3 | $10K to $1M | 0.25% | 0.40% |

| Advanced 4 | $50K to $5M | 0.15% | 0.25% |

| Advanced 5 | $500K to $10M | 0.10% | 0.20% |

| Advanced 6 | $1M to $15M | 0.07% | 0.16% |

| Advanced 7 | $15M to $75M | 0.05% | 0.14% |

| Advanced 8 | $75M to $250M | 0.02% | 0.10% |

| Advanced 9 | $250M+ | 0.00% | 0.08% |

- Maker Fees: These apply when you place an order that doesn’t immediately get matched with a buyer.

- Taker Fees: These apply when your order is filled immediately by an available seller.

Additional Features:

- Minimum Trade: Coinbase allows users to purchase as little as $1 worth of cryptocurrency. However, note that this can come with a $0.50 fee, significantly impacting smaller trades.

- Crypto Selection: With over 240 cryptocurrencies and more than 350 crypto-to-crypto trading pairs, Coinbase offers one of the largest selections on the market, giving users access to a wide variety of digital assets.

While Coinbase is perfect for newcomers due to its ease of use and educational resources, traders seeking lower fees may want to consider alternatives or explore Coinbase’s advanced trading options.

*Is ‘buy-and-hold’ a clever way to trade cryptocurrencies?

Binance – Best for Advanced Traders

Binance is one of the largest cryptocurrency exchanges by trading volume, making it a top choice for advanced traders. Known for its extensive range of trading tools and low fees, Binance is a powerful platform for users who actively trade crypto-to-crypto and want access to features like margin trading, futures trading, and staking.

Key Features for Advanced Traders

- Margin and Futures Trading: Binance offers margin trading for those who want to borrow funds to trade larger positions and futures trading for users looking to speculate on the future price of assets. Both tools cater to experienced traders who are comfortable with high-risk strategies.

- Staking and Advanced Tools: Binance also supports staking, allowing users to earn rewards by holding their crypto. Other features include options trading, lending, and liquidity pools, offering various ways to engage with the market.

- Low Fees: Binance stands out for its low trading fees, which can be further reduced by using its native token (BNB). Fees start at 0.10%, making it an affordable option for frequent traders.

- High Liquidity: As the exchange handles large trading volumes, it offers high liquidity, which helps ensure fast execution and minimal price slippage for crypto trades.

Pros:

- Large selection of trading pairs.

- Low fees for crypto-to-crypto trades.

- Extensive trading features for advanced users.

Cons:

- Major regulatory concerns in multiple regions.

- No support for U.S. dollar deposits or purchases.

– Where it Shines and Falls Short

Where it shines:

- Crypto Pairs: Binance.US offers a wide range of crypto trading pairs, making it ideal for users focused on trading cryptocurrencies for one another.

- Low Fees: Binance’s fee structure varies based on trading volume and asset type, but some Bitcoin trades are free, making it competitive for crypto-to-crypto trades.

Where it falls short:

- No Cash Support: In June 2023, Binance.US transitioned to a “crypto-only” exchange, no longer accepting U.S. dollars for purchases. This limits its function compared to other centralized exchanges.

- Regulatory Issues: Binance faces significant regulatory scrutiny. The U.S. Securities and Exchange Commission accused Binance of various violations, including mishandling customer funds. Additionally, Binance.US isn’t available in all 50 U.S. states, and several states have paused onboarding new users.

Fees and Availability

- Fees: 0%-0.6%, depending on the payment method and trading volume.

- Account Minimum: $0.

- Unavailable States: Binance.US does not operate in Alaska, Hawaii, New York, Texas, and several other U.S. states and territories.

*What is cryptocurrency staking?

– Best for Security

Crypto.com stands out as one of the most secure cryptocurrency exchanges, offering top-notch protective features like offline cold storage and multi-factor authentication. These security measures make it the best cryptocurrency exchange for users who prioritize keeping their assets safe from potential security breaches.

Top Security Features

- Offline Cold Storage: The majority of user funds are stored in cold storage, keeping them offline and secure from hackers.

- Multi-Factor Authentication (MFA): Crypto.com enforces multi-factor authentication for login and transactions, adding an extra layer of protection to user accounts.

- Third-Party Audits: The platform is regularly audited by independent third parties, and ranks highly in exchange security rankings, providing additional assurance to users.

Competitive Fees and Spending Flexibility

Crypto.com offers competitive fees, especially for users funding accounts via bank transfers. Holding the platform’s native token (CRO) can further reduce trading fees, making it a cost-effective option for active traders. Additionally, Crypto.com’s Visa card allows users to spend crypto directly, giving them the flexibility to use their digital assets for everyday purchases.

Pros:

- Large selection of crypto assets and trading pairs: With over 350 cryptocurrencies, Crypto.com offers one of the broadest selections available.

- Low fees if you fund your account with cash transfers.

- Straightforward staking program: Crypto.com’s staking services are easy to use and offer competitive rewards.

Cons:

- Some services are not offered in the U.S., limiting availability.

- High fees for withdrawing cryptocurrency.

- High minimum withdrawal requirements, which can be a barrier for smaller traders.

Fees and Account Minimum

- Fees: 0% – 4%, depending on the transaction type and funding method.

- Account Minimum: $0 (though fees vary by type of transaction, and other fees may apply).

Where Shines

- Selection: With more than 350 cryptocurrencies on its exchange, Crypto.com offers a larger selection than any other service reviewed by FXLeaders. This extensive range of assets makes it ideal for traders looking to explore various markets.

For users who prioritize security alongside a wide selection of crypto assets, Crypto.com offers a reliable, feature-rich platform that excels in both areas.

Gemini – Best for Institutional Investors

Gemini is a trusted platform for institutional investors due to its strong focus on regulatory compliance and security. Founded by the Winklevoss twins, Gemini has earned a reputation for operating within legal frameworks and providing a professional-grade trading platform that caters to high-volume traders and large institutions.

Key Features for Institutional Investors:

- Regulatory Compliance: Gemini operates under U.S. regulatory standards, offering peace of mind to investors seeking a fully compliant exchange.

- Security: Gemini emphasizes security, utilizing cold storage, multi-factor authentication, and insurance for digital assets held in its hot wallets.

- Advanced Trading Platform: Gemini’s ActiveTrader platform is designed for professionals, offering advanced charting tools, real-time market data, and competitive fees for high-volume traders.

Pros:

- High level of regulatory compliance.

- Top-tier security features, including insurance for hot wallets.

- Professional trading platform suitable for institutional and high-volume traders.

Cons:

- Higher fees compared to some competitors.

- Limited selection of cryptocurrencies compared to other exchanges.

Fees and Account Minimum:

- Fees: 0.5% – 1.49% depending on the trading volume.

- Account Minimum: $0, but trading fees can be higher for small transactions.

Kraken – Best for Security and Long-Term Investors

Kraken has established itself as one of the oldest and most secure cryptocurrency exchanges, making it a top choice for long-term investors. Kraken is known for its longevity in the market, having never experienced a major hack, and offers robust features such as margin trading and a variety of advanced trading tools.

Key Features for Long-Term Investors:

- Strong Security: Kraken offers industry-leading security features, including cold storage, multi-factor authentication, and PGP encryption for communication.

- Advanced Trading Features: For more experienced traders, Kraken offers margin trading and futures trading, enabling users to trade with leverage.

- Longevity and Trustworthiness: Kraken has been in operation since 2013 and has built a solid reputation for security and customer support.

Pros:

- Excellent security track record, having never been hacked.

- Offers margin trading and futures trading for advanced users.

- Competitive fees and features for long-term crypto trading.

Cons:

- Interface may not be as beginner-friendly as other platforms.

- Not available in all regions.

Fees and Account Minimum:

- Fees: 0.16% (maker) and 0.26% (taker) for spot trading.

- Account Minimum: $0.

KuCoin – Best for a Wide Selection of Coins

KuCoin is known for offering one of the largest selections of cryptocurrencies, with over 600+ crypto assets available for trading. The platform is ideal for users looking to trade a wide variety of coins while benefiting from competitive fees. KuCoin also supports advanced features like staking and lending, making it a versatile choice for both casual and experienced traders.

Key Features for Traders:

- Extensive Coin Selection: KuCoin offers over 600 cryptocurrencies, allowing users to explore niche markets and new projects.

- Competitive Fees: KuCoin’s trading fees are low, with further discounts available when using the native KCS token.

- Advanced Features: The platform supports staking, lending, and margin trading, giving users multiple ways to earn from their crypto holdings.

Pros:

- Huge selection of cryptocurrencies and trading pairs.

- Low trading fees, especially when using the KCS token.

- Offers staking and lending options to generate passive income.

Cons:

- Not licensed in the U.S., limiting access for American users.

- Customer support can be slow to respond to issues.

Fees and Account Minimum:

- Fees: 0.1% per trade, with further discounts when using KCS.

- Account Minimum: $0.

*One trading approach has stood the test of time, even in the revolutionary cryptocurrency market. Learn about price action cryptocurrency trading now!

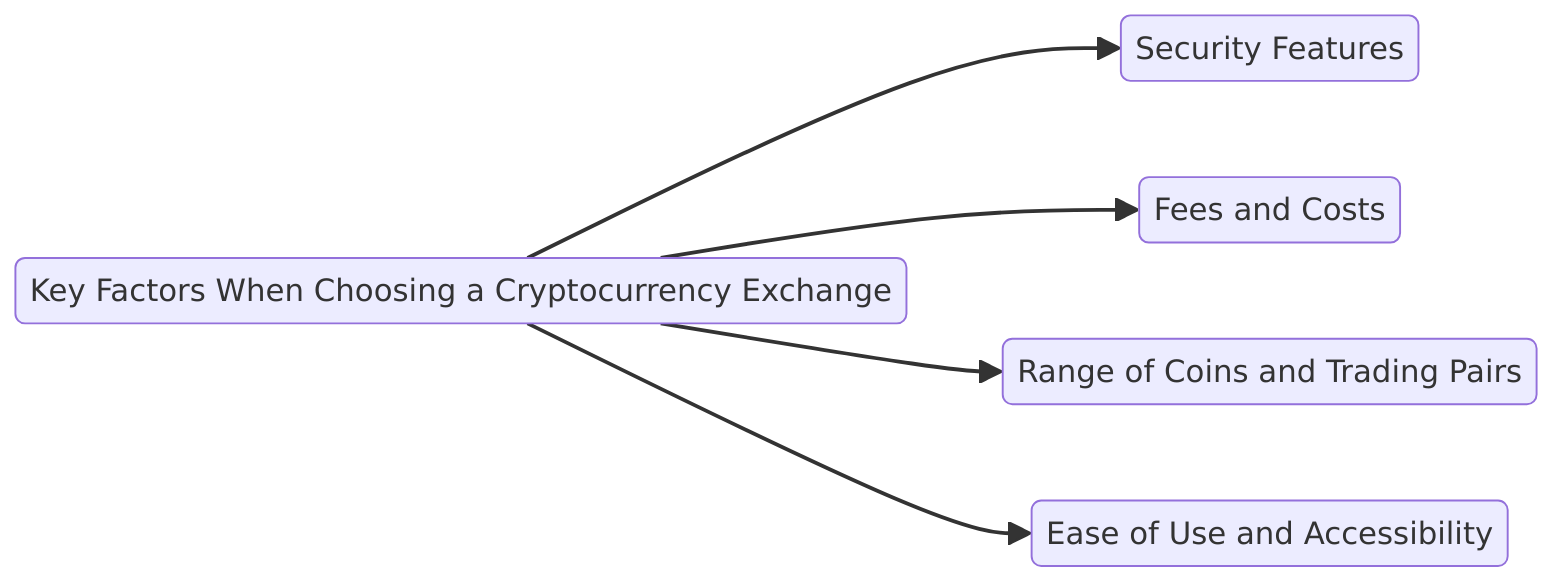

Key Factors to Consider When Choosing a Cryptocurrency Exchange

How do you select the best cryptocurrency exchange for you?

When selecting a cryptocurrency exchange, it’s important to evaluate several key factors to ensure you choose a platform that aligns with your needs. Let’s explore some critical features to consider.

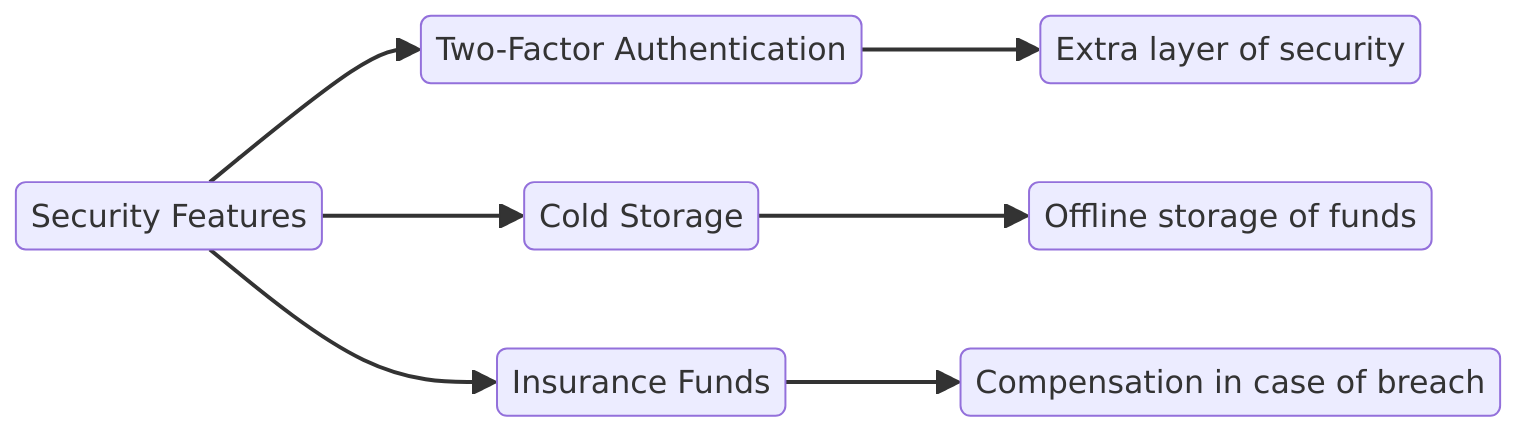

Security Features

Security should be a top priority when choosing an exchange. Leading platforms use strong security measures to protect users from potential security breaches.

- Two-Factor Authentication (2FA): This feature requires users to verify their identity with an additional layer of security beyond just a password. It ensures that even if one layer of security is compromised, hackers cannot access the account without the second factor.

- Cold Storage: The best exchanges store the majority of funds in cold storage, keeping them offline and safe from hacking attempts.

- Insurance Funds: Some exchanges, like Coinbase and Binance, offer insurance funds that compensate users in case of a security breach or hack, adding another layer of consumer protection.

Security is crucial for protecting your crypto wallet and digital assets, so ensure the exchange you choose offers these essential protections.

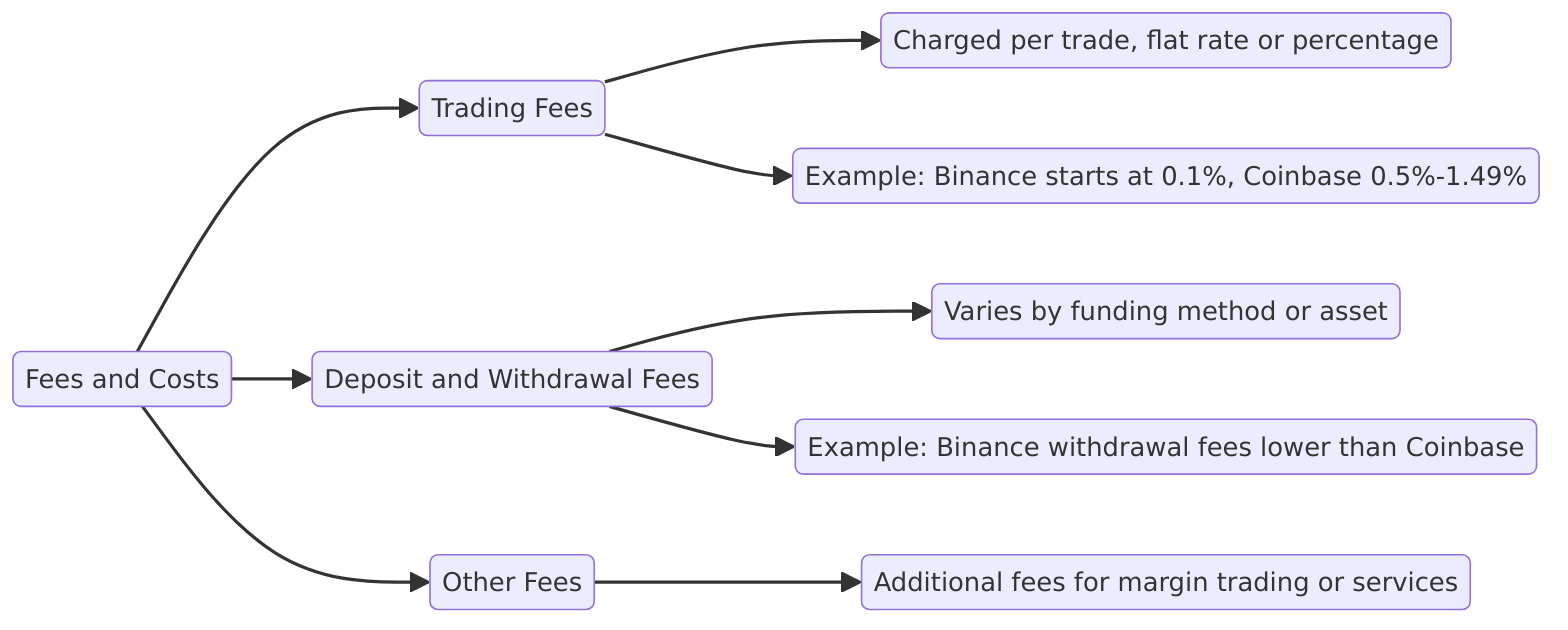

Fees and Costs

Exchanges charge a variety of fees, and understanding these is key to selecting the most cost-effective platform for your trading activity. The most common fees include:

- Trading Fees: These fees are charged per trade and can either be a flat rate or a percentage of the transaction. For example, Binance offers low trading fees starting at 0.1%, while Coinbase typically has higher trading fees around 0.5%-1.49%.

- Deposit and Withdrawal Fees: Some platforms charge fees for depositing or withdrawing funds. These can vary based on the funding method (e.g., bank transfer, debit/credit card) or the asset being withdrawn. For instance, Binance’s withdrawal fees are lower compared to Coinbase, which tends to charge more for both deposits and withdrawals.

- Other Fees: Platforms may charge additional fees for margin trading or using certain services, so make sure to review the complete fee structure before signing up.

Evaluating these crypto exchange fees will help you minimize costs, especially if you plan on trading frequently.

Range of Coins and Trading Pairs

The number of crypto assets supported on an exchange is another critical factor. Some exchanges offer a few dozen coins, while others, like KuCoin and Binance, offer hundreds.

Additionally, the availability of trading pairs is essential for users who want to trade between different cryptocurrencies without converting back to fiat. For instance, exchanges that offer pairs like BTC/ETH or ETH/USDT give traders flexibility in managing their portfolio.

Before choosing an exchange, make sure it supports the cryptocurrency transactions and trading pairs you are interested in.

Ease of Use and Accessibility

A user-friendly platform is crucial, especially for beginners entering the world of crypto. Platforms like Coinbase are designed with simplicity in mind, offering intuitive interfaces and mobile apps that make it easy to navigate, trade, and manage your account.

- Mobile Apps: Many leading exchanges offer mobile apps, allowing users to monitor and manage their portfolios on the go.

- Beginner-Friendly Platforms: If you’re new to crypto, look for exchanges like Coinbase or Kraken that offer educational resources and a straightforward crypto exchange account setup process to guide you through your crypto journey.

A simple, accessible platform will help you focus on your trading strategy instead of struggling with complex features.

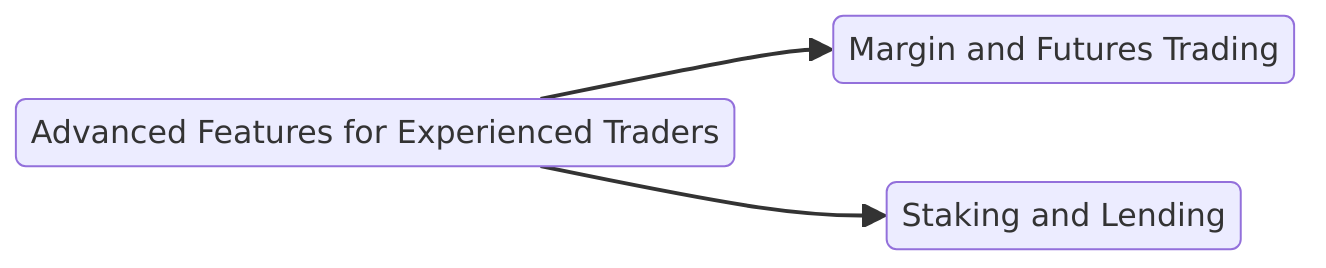

Advanced Features for Experienced Traders

For experienced and professional traders, some exchanges offer advanced tools like margin trading, futures trading, staking, and lending. These features allow traders to take on more complex strategies, potentially amplifying both profits and risks.

Margin and Futures Trading

Margin trading allows traders to borrow funds to trade larger positions than their account balance would otherwise allow. This leverage can significantly increase the potential for profit, but it also magnifies the risk of loss. If the market moves against a trader’s position, they may be required to repay more than their initial investment.

- Margin Trading Example: On platforms like Binance and Kraken, traders can borrow funds and trade with leverage of up to 10x or more. For example, if you have $1,000 and trade with 5x leverage, you control $5,000 worth of crypto. However, if the market moves unfavorably, losses can exceed your initial investment.

Futures trading enables traders to speculate on the future price of an asset without owning it directly. It involves betting on whether the price of a cryptocurrency will rise or fall at a specified date. Advanced traders often use futures to hedge other positions or engage in speculative trades.

- Futures Trading Example: A trader could enter a futures contract on Ethereum (ETH), betting that the price will increase over the next month. If ETH rises, the trader profits from the price difference. However, if ETH falls, the trader incurs losses.

Both margin and futures trading offer potentially high rewards but carry significant risks, making them suitable only for advanced traders comfortable with volatility and risk management.

Staking and Lending

Staking allows traders to earn staking rewards by locking up their crypto assets to support the operation of a blockchain. This process is most commonly associated with Proof of Stake (PoS) blockchains, where staked assets help validate transactions and secure the network.

- Staking Example: On exchanges like Binance or KuCoin, users can stake coins like Ethereum (ETH) or Polkadot (DOT), earning rewards over time. These rewards, paid in the staked cryptocurrency, offer a way for traders to generate passive income while holding onto their assets.

In addition to staking, crypto lending allows users to lend their assets to others in exchange for interest. Platforms like KuCoin enable users to lend cryptocurrencies such as Bitcoin (BTC) or Tether (USDT), earning interest from borrowers over a set period.

Both staking and lending provide opportunities for passive income, making them attractive to long-term holders who want their crypto assets to work for them while they wait for price appreciation.

Conclusion: Your Crypto Journey Starts with the Right Exchange

Choosing the right cryptocurrency exchange is one of the most important steps in starting your crypto journey. With so many options available, it’s crucial to evaluate exchanges based on key factors like security, fees, and the features they offer. Whether you’re a beginner or an experienced trader, finding the best cryptocurrency exchange for your needs can help you trade safely, minimize costs, and access the tools that will help you succeed in the market.

From exchanges like Coinbase with its user-friendly interface and strong security, to platforms like Binance that cater to advanced traders with low fees and robust trading tools, the right choice depends on your goals as a trader or investor.

As you begin your crypto journey, consider what matters most to you—whether it’s the range of supported crypto assets, ease of use, or advanced features like staking and margin trading. By carefully selecting an exchange that aligns with your goals, you’ll be well-positioned to navigate the exciting world of cryptocurrency.

Start your crypto journey today by choosing the exchange that meets your needs and begin trading confidently.

Not sure what coin to start with? Check out our guide on the top 10 cryptocurrencies.